Features for employee cardholders

- Physical card delivered to employee’s home address

- Self-service card activation

- Employees can review their live balances and recent transactions in your app

- Option for employee to view personal budget in their home currency

- App notifications for employee about purchases / declines

- Self-service card PIN change

- Freeze/unfreeze card

- Report lost/stolen card

- Multifactor authentication to view sensitive card details in app

- 3-D Secure checks for online purchases including biometrics

- Chip-and-PIN and contactless for in-person purchases

- All employee spend funded by company wallets

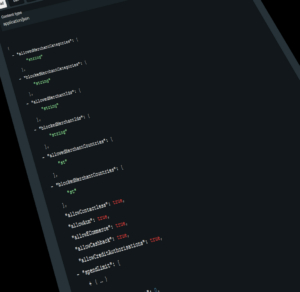

- Unwanted / unauthorised spend is blocked via rules that can be configured down to the individual card level

- New joiner employees can be automatically issued with a card as part of their welcome pack

- Card renewal service

- Card removal linked with offboarding of staff in HR system

- Card delivery options based in UK and EU, with international delivery available subject to programme terms

- Card fulfillment pay-as-you-go with no required commitments; however, Employers (or Embedder) can opt to save costs by pre-investing in batches of card stock

- Fees and charges around cards can be priced by you to fit within your overall product pricing

- Design and brand cards under your app logo and/or employer branding

- As the Embedder you can offer premium card materials and design options as an upsell