Turn in-store loyalty from a data desert into attributable spend

Mobile is a powerful platform for loyalty, but in-store, the journey often breaks at the PoS. Scanning codes, manual checks and app-specific flows slow till queues and limit adoption. Moreover, actual loyalty activity sits apart from transactions, leaving retailers without a clear view of what drives spend or repeat visits.

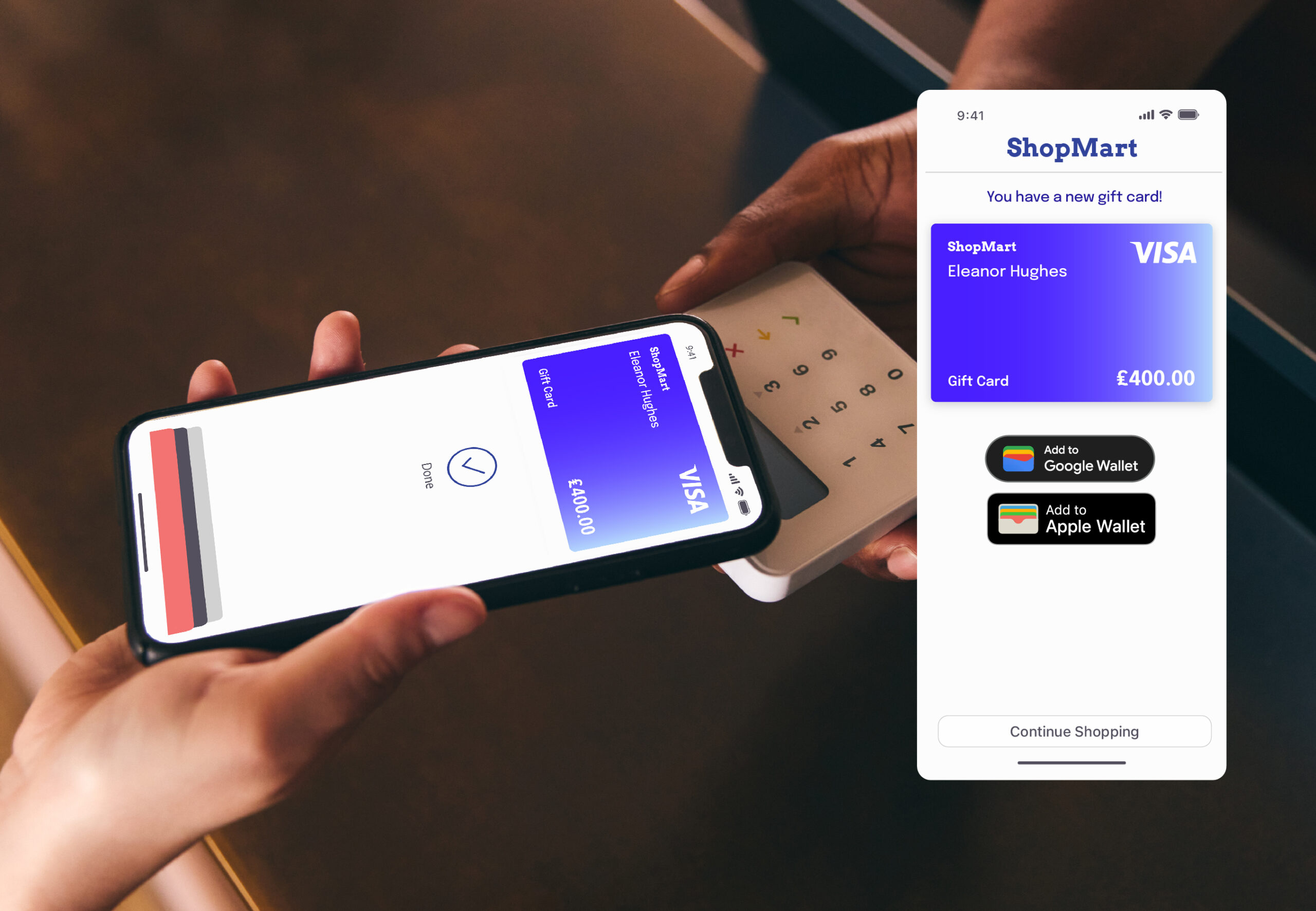

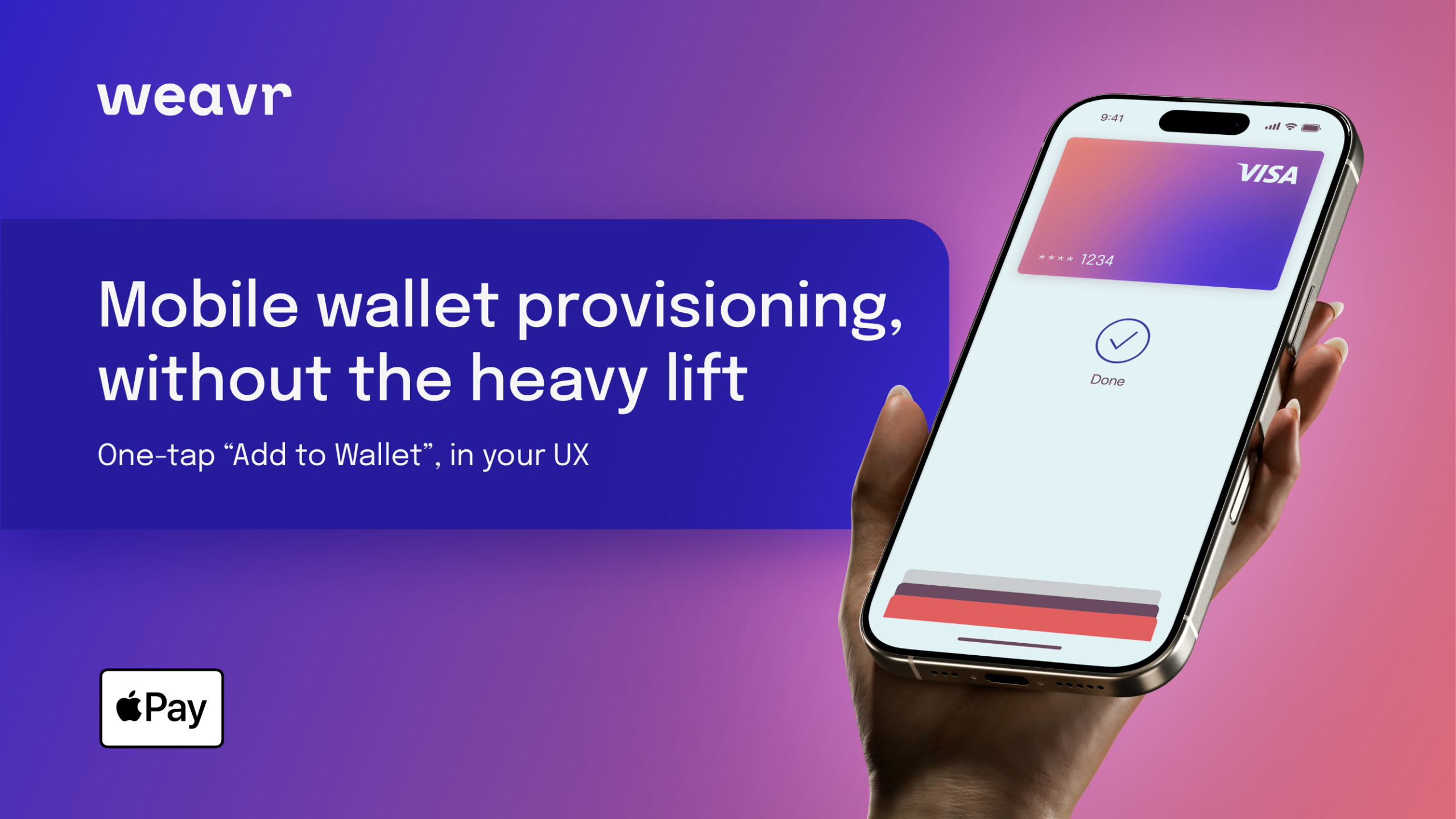

Weavr closes the gap by moving loyalty onto the card rails retailers already accept. With wallet-native virtual cards, customers can earn and redeem points seamlessly at existing tills without PoS changes. Loyalty becomes part of the tap-to-pay experience, turning engagement into usable transaction signals.