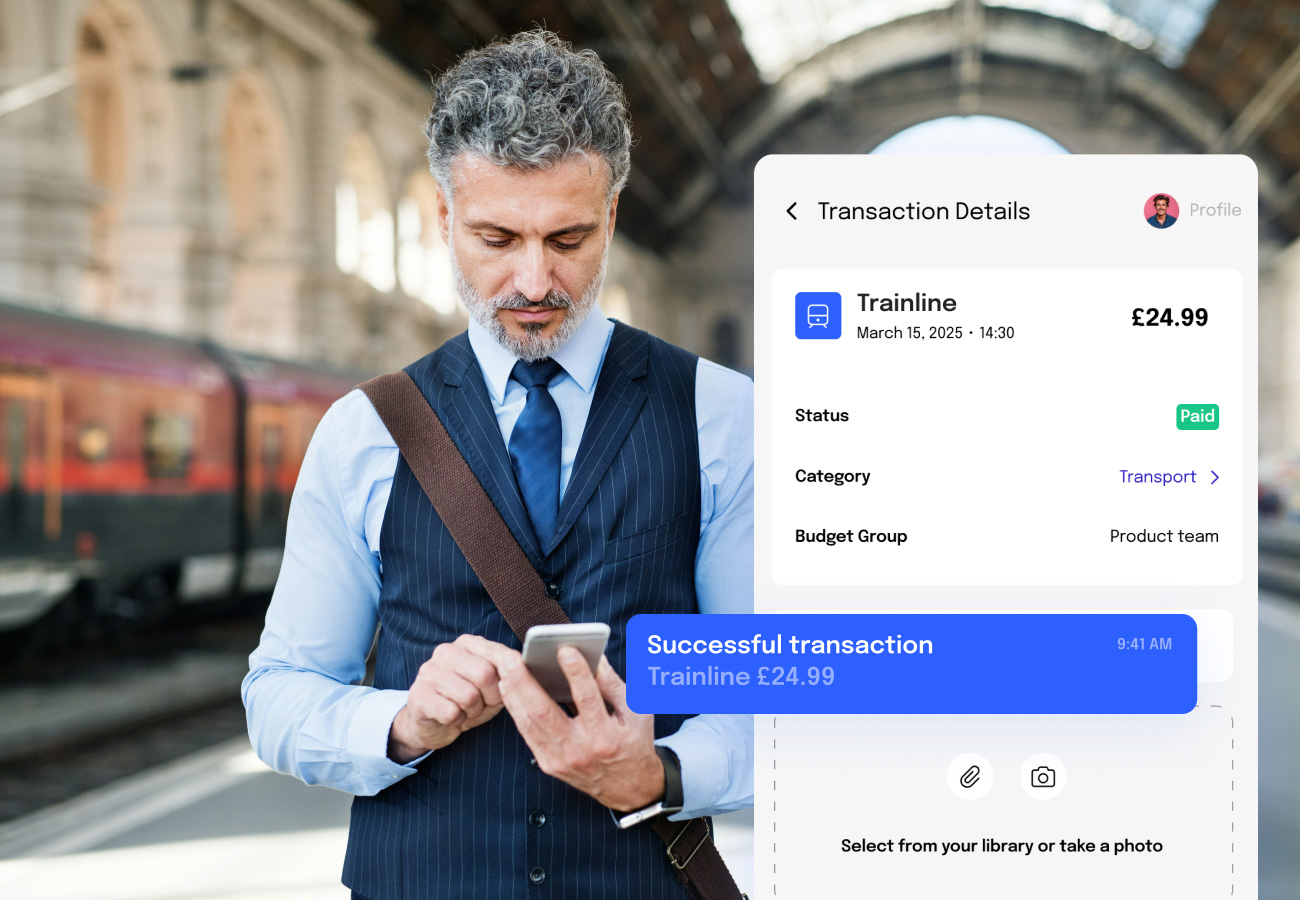

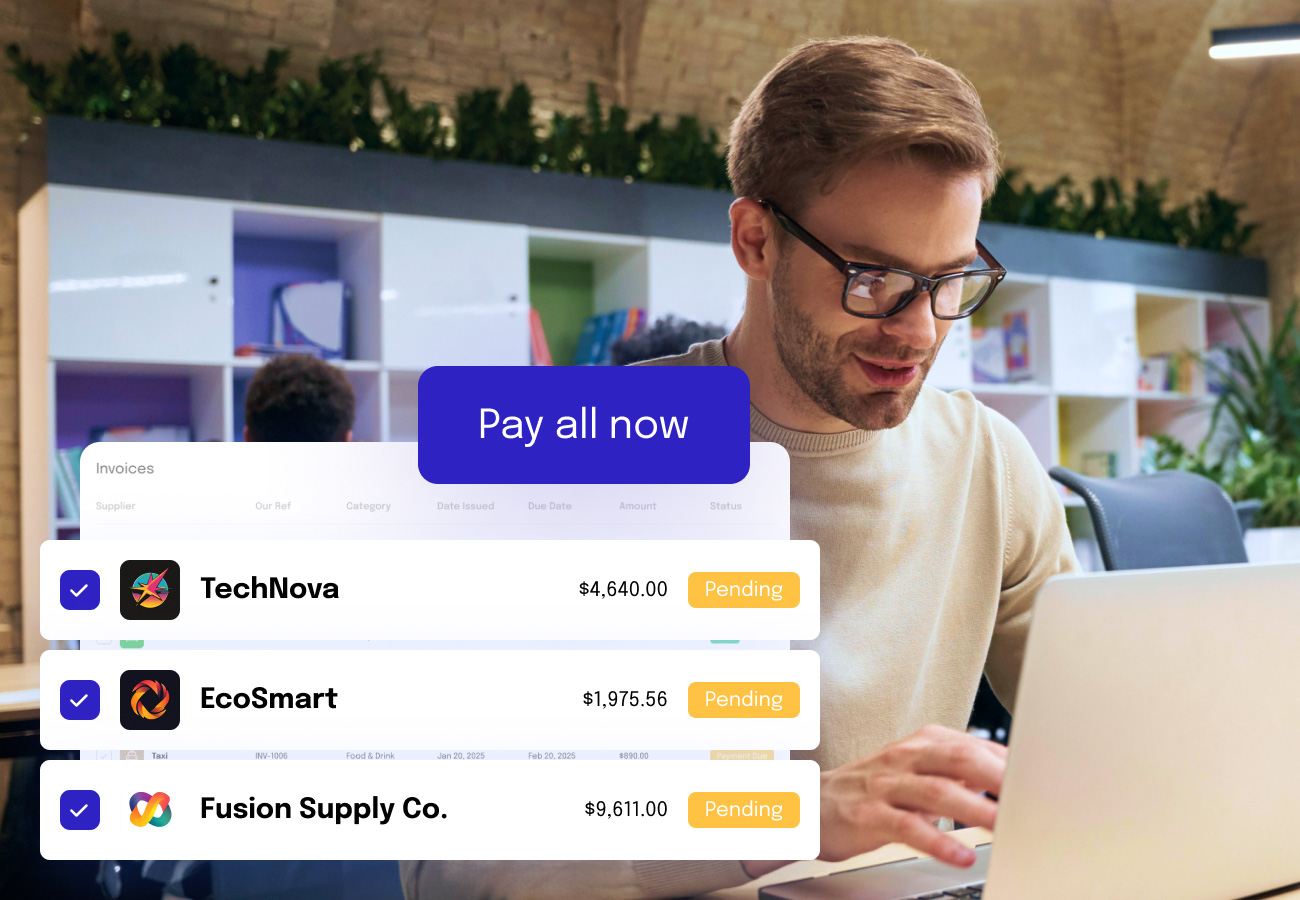

Enable employers to manage expenses the smarter way, inside your app

Employees spending out of pocket on business expenses is rapidly becoming a thing of the past. Instead, they can be issued a commercial card within your accounting app, which debits from company funds when they spend on authorised categories and merchants.