B2B SaaS companies in the UK are facing increased revenue pressure, with churn rates rising and customer retention harder than ever. As product teams look for new ways to drive growth and monetisation, embedded finance is fast becoming a top strategic priority. According to new research, 74% of B2B SaaS product managers have embedded finance on their roadmap for 2025—with own-branded debit cards and payment wallets leading the way.

In this article and webinar, we explore why embedded finance is gaining traction now, what’s changed to remove previous barriers to adoption, and how SaaS platforms can leverage it to increase product value, reduce friction, and unlock new revenue streams.

SaaS has been hugely successful at adoption by businesses large and small in the past decade. But now, for the first time ever, B2B SaaS is under serious revenue pressure – with churn or downgrades on the increase. B2B SaaS payments are firmly on the agenda, as you can see in our latest webinar below:

Webinar Join the 74%: The cost of ignoring embedded finance 👇

Anecdotally, we can see this shaking out in the layoffs and hiring freezes that are at large in the industry. Statistically, the state of SaaS can be seen in the SaaS Capital Index™, which shows that revenue growth rates have slowed for all sizes of public SaaS companies.

After several years of early adopters experimenting with embedded finance, testing its boundaries, and demonstrating its value, our research indicates that embedded finance is poised to enter the majority of product pipelines in B2B SaaS. According to our research, this year will see huge adoption in B2B SaaS payments.

(There’s more in the guide, but we’re guessing you want to get right to the stats? Right this way please.)

Key findings from our embedded finance for UK B2B SaaS platforms research

Embedded finance is on the very-near horizon for most B2B SaaS platforms

It could be a revenue-tight future, and while embedded finance is in its nascency at the moment, it could be growing up just in time.

The intention to embed is very high among B2B product managers, who are making a clear revenue-focused bets on this new technology alongside other emerging technologies, such as AI.

We can see that this decision points to product managers, much like yourself, placing embedded finance firmly on roadmaps already when it comes to B2B SaaS payments. And, as we share in the white paper, the current base of adoption is quite low.

The key question is ‘why?’ One reason is for a clear competitive advantage. In fact, 55% of product managers believe that embedded finance will edge their product ahead of their rivals. The rest you can read, in-depth, in the full research white paper.

So you’ve reviewed the statistics and key highlights of the findings and want to delve deeper into why embedded finance has become a higher priority for UK B2B SaaS platforms. You can download the full story right here:

The path towards profitability for UK B2B SaaS platforms can be accelerated by embedded finance… and it looks like it’s a path most product managers are planning to take. After several years of early adopters experimenting with embedded finance, testing its boundaries, and demonstrating its value, our research indicates that embedded finance is poised to enter the majority of product pipelines in B2B SaaS.

Why embedded finance has changed

“New approaches to embedded finance are now coming to the market. The compliance burden, while fully acknowledged, is now less of a barrier for SaaS businesses…

The earliest examples of B2B digital businesses using embedded finance (beyond payment acceptance, with services that require on- boarding) were marketplaces that needed payments infrastructure that was more complex than just accepting e-payments.

Fintechs simply accepted this [compliance burden] development as part of the cost of being in the business they wanted to be but, for SaaS businesses, the barrier to adoption of embedded finance got progressively higher, taking it beyond their appetite.

New approaches to embedded finance are now coming to the market to address this barrier. With these more mature, more comprehensive embedded finance solutions, the compliance burden, while fully acknowledged, is now less of a barrier for SaaS businesses. The next generation providers of embedded finance solutions already largely cater for it.”

Alex Mifsud, Co-founder and CEO, Weavr.

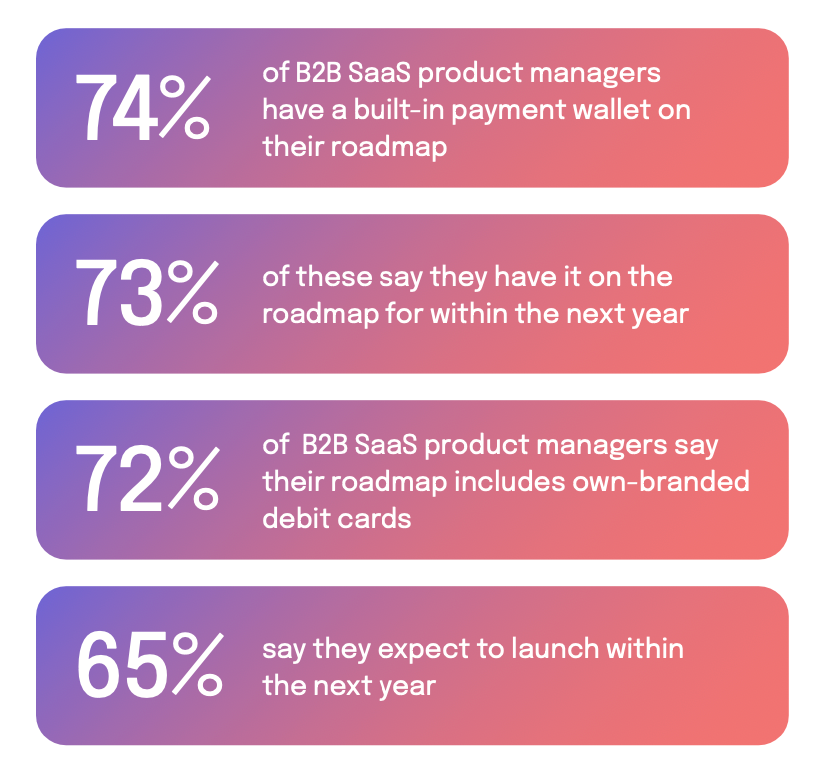

74% of B2B SaaS product managers have embedded finance on their roadmap.

72% plan to include own-branded debit cards.

The overwhelming majority of B2B SaaS product managers are prioritising embedded finance. Nearly three-quarters have integrated payment wallets into their strategic plans, with 72% also eyeing the addition of own-branded debit cards.

This significant adoption rate underscores the industry’s shift towards embedding financial services to enhance platform capabilities and meet evolving customer demands.

Embedded finance has come of age at the right time

Embedded finance isn’t the only option open to product managers right now. The possibilities also inevitably include AI – whether that’s machine learning, predictive AI, or GenAI – and the ability of SaaS businesses to monetise this value are still at an experimental stage in most scenarios – as embedded finance has also been until recently.

B2B SaaS platforms may have held off on embedded finance in the past because it appeared too complex, too untested, too out of reach to implement, and in some instances embedded finance has been these things – especially when we look at the first-wave of BaaS providers and adopters.

This confusion hasn’t been limited to SaaS providers, either. When we surveyed UK banking executives in 2023, almost every respondent (99%) identified at least one area of uncertainty that was holding them back from implementing embedded finance.

This picture has now changed, especially for B2B SaaS providers. The current rate of adoption suggests it is entering the mainstream. You could say embedded finance is coming out of adolescence, and our research shows that the industry recognises this change:

Product is now responsible for delivering commercial outcomes. Attracting new users is hard, hence improving retention becomes key to drive product-led growth.

Customers expect a no-hassle payments experience and friction can lead to choosing the alternative. However, payments are heavily regulated, prone to fraud, and require specialized knowledge.

While Embedded Finance is a fantastic way to improve customer experience it is not the core of SaaS businesses. Offering financial solutions via a trusted partner is a smart move so that they can focus on enhancing their value added propositions and prioritizing resources to do so.”

Monica Millares, Principal Product Ways of Working at BigPay, “Purpose Driven FinTech” Podcast Host.

Within a couple of years, most of these companies’ embedded finance solutions will have reached the market. And while many of them will inevitably be exploring different use cases and catering for different target audiences, customer and user expectations for B2B SaaS are bound to change as a result.

Embedded finance is ready for prime time. It’s no longer the experimental technology adopted only

by industry giants and outliers. In the hands of some providers, it’s become more accessible, more robust, and set for mass adoption.

Survey methodology

Ready to see how embedded finance could work for your SaaS platform?

If you’re exploring ways to increase revenue, improve customer retention, or enhance your payments experience, our team is here to help.

Book a 15-minute call with one of our experts to find out how embedded finance can fit into your roadmap—without the complexity.