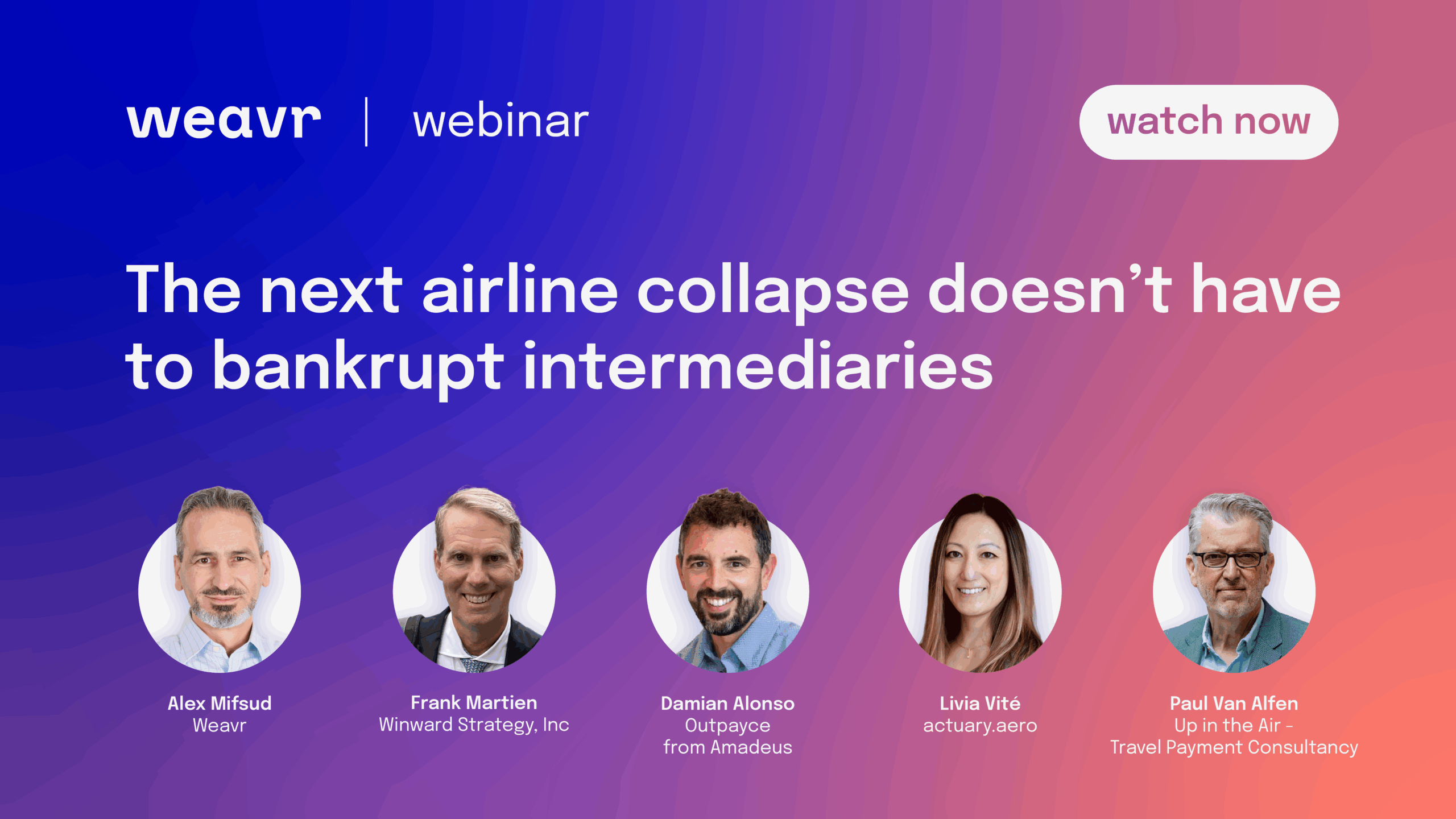

Our panel of senior travel payment experts explore why airline failures create cascading losses – and how pairing issuing with acquiring can finally give the industry control.

Meet the speakers:

Livia Vité – CEO, actuary.aero

Damian Alonso – Head of Product & Partnerships, Outpayce (Amadeus)

Paul van Alfen – Independent Travel Payments Consultant

Frank Martien – Managing Partner, Windward Strategy

Alex Mifsud – CEO and Co-founder, Weavr.io

What the experts exposed:

The panel reveals the hidden forces that turn airline failures into industry-wide shocks – and why pairing acquiring with issuing is the first real way to regain control. Key takeaways:

1. “Many airlines remain vulnerable… their capital structures can be fragile.” — Alex Mifsud

Airline failures still send financial shockwaves downstream, creating sudden liquidity pressures for intermediaries and acquirers.

2. “Data in or data out is only as good as the data in.” — Livia Vité

Without clean, connected booking and fulfilment data, no party can accurately see or manage its true exposure.

3 . “Connecting both together lets you kill two birds with one stone.” — Damian Alonso

Pairing issuing with acquiring finally unites the pay in and pay out flows, giving platforms control of timing, cash and chargeback protection.

4. “If the travel intermediary uses a virtual card… both sides need to agree for it to work end to end.” — Paul van Alfen

Agencies carry the risk unless their payment setup is aligned with suppliers, with virtual cards used in a way both sides can support.

5. “OTAs don’t have the ability to track those payments… and join them back up.” — Frank Martien

Disconnected data leaves intermediaries exposed when refunds surge, making disputes harder to defend and losses harder to contain.